Are you looking for the best way to invest 100k safely?

Whether the money is from a windfall event such as selling a small business, a larger home, an inheritance, or from retirement savings, if you’ve come into 100k you can make that money work for you.

If you are smart, you can learn how to invest and not spend the amount even before it lands in your bank account. After all, your $100,000 does not guarantee financial security unless you invest in a way that compounds.

So, approach investing with caution.

Read on to find out more about what to do before investing your $100k, how to know your investment personality, and the best investments you can make with your money.

Before Investing $100,000

It is tempting to throw all your money into things that make you happy. However, take some time and take care of these two financial priorities as soon as the $100k is in your account.

Pay Down Your High-Interest Debt

Consider paying down any debt before making an investment. Make your high-interest credit card debt or loan a priority because the interest rate may be greater than your investment’s growth rate.

For instance, the Annual Percentage Rate (APR) of a credit card is around 17%, which is higher than the average stock market return. The return is also significantly higher than the returns you get from steady investments such as bonds.

Also, prepay your mortgage, so you make extra payments that will reduce the loan length. There is also the option to recast your mortgage and free up more cash.

Try the snowball technique if you have high debt, which involves paying off the smaller debts first. Otherwise, prioritize high-interest debt first using the avalanche technique.

Whichever method you use, it is wise to pay creditors. Clearing loans will help relieve some of the debt mental burden.

Build Your Emergency Fund

An emergency fund is money you put aside in case something occurs. For example, an unexpected job loss means you need enough savings to bridge the gap until you find another job.

If you have an emergency fund already, outstanding! Examine the fund and make sure it is still funded. The emergency fund for many people covers six months’ worth of living expenses.

Individual risk tolerance determines how much you put in the emergency fund and where you keep it. The best place to start is by keeping a full six months’ worth in a deposit account.

However, other people will keep three months’ worth. These individuals may consider investing their money in a fund where the principal offers a higher return.

Whichever way you approach it, ensure you have an emergency fund that will last for a few months.

Handle Taxes Now

While the focus is on making smart investments, an equally critical aim is to keep as much of your $100k lump sum as possible. Some situations require your immediate attention to avoid unwanted attention from the IRS.

Here are some example scenarios.

After Liquidating Your 401(k) After Leaving a Job

You have two months (60 days) after the employer cuts your check to put the money in your account like a Roth IRA or traditional IRA. Otherwise, you will face a hefty tax bill that comprises taxable income and a 10% early withdrawal penalty.

Inheriting IRA

IRA rules on what the beneficiaries can or cannot do will vary, as well as the timeline for acting without triggering extra taxes or penalties. It depends on the relationship with the deceased.

Determine Your Investor Profile Before Investing

Investing is risky business. The key to successful investments is identifying your risk profile and investing accordingly.

Conservative investors experience sleepless nights if they invest in a volatile stock market.

Risk also depends on your age. For example, young individuals can invest in equity markets that are not suitable for elderly people approaching retirement.

As you learn how to invest 100k, know the investor you are. Your profile determines the best type of investments depending on such things as financial condition, age, aversion to risk, and investment goals.

Create your asset allocation and handle trades on your own if you prefer doing the research. Consider opening a brokerage account that provides access to various financial products.

For the newbie or any investor that does not want to worry about the nitty-gritty of locating investments, consider a robo-advisor. These services build and manage your preset investment plan depending on your goals and current situation.

Work with human financial advisors if you are looking for in-depth financial guidance. The advisor may help create and manage your investments and financial plan.

Finally, you need to consider your risk tolerance. A financial advisor or robo-advisor may use questionnaires to gauge your risk tolerance.

What is Risk?

Your risk-taking appetite is how much you are willing to lose. Risk is a critical consideration in your investment profile. More risk offers higher potential returns from the investments you make.

A young investor can take on a higher risk and invest a smaller amount in risky assets. In case the short-term return fails, they still have time to adjust their strategy and shift to more conservative investment tools.

Older investors close to retirement should look for less volatile markets. These markets may affect the return but will not deplete the capital.

Risk Profiles

Your investor risk profile may fall into the high, medium, or low category.

Low Risk (Conservative)

These are investors concerned about their capital. You do not want to erode your capital and prefer high-quality money market and debt instruments. Conservative investors also do not mind lower but steady returns that offer moderate capital growth.

Medium Risk (Balanced)

Medium risk investors will take on a bit of the choppiness in the value of their portfolios. You most likely want a slightly volatile portfolio but with higher returns.

A balanced portfolio includes a mix of bonds and shares from stable companies. Your investment portfolio may include a small proportion of risky assets for improved capital growth.

High Risk (Aggressive)

Aggressive investors are ready to expose their portfolios to higher volatility and high risk for capital growth. These investors expose themselves to volatile equity markets and also invest in unknown and small businesses they expect to do well.

A high-risk investor also wants to invest via leveraged products. This investing form is not for the faint-hearted, and certainly not for those with limited capital.

Best Way to Invest 100k: 5 Smart Strategies

There are several investment options available if you have disposable income. But which option is best for you?

This section addresses the different options, so you find the best way to invest 100k and manage your finances.

Invest in the Real Estate Market

A common option for those looking to invest $100,000 is real estate. Fortunately, the process is not as complicated or time-consuming as purchasing a rental property.

Here are the main options when you choose real estate investments.

Traditional Real Estate

The traditional method of investing in the real estate market is you purchase a property and renovate it and sell it, or you can hold on to it and rent it out. This investment option requires significant upfront personal capital. So, a sizable chunk from your $100k would go into the process.

However, the chances of finding a significant commercial property with $100,000 are low. But you can partner with others. Also, make sure you review the purchase and sale agreement carefully before you commit.

Real Estate Investment Trusts (REITs)

You may purchase into a real estate investment trust at a low cost and earn instant diversification in the real estate industry. REITs make it easy for you to invest in different property types and distinct areas.

However, you have little control over where your money goes in a real estate investment trust. Managers decide where they place the investments. You can always sell your REIT stake, but this defeats the idea of a purchase-and-hold investment strategy.

Crowdfunding

Real estate crowdfunding is a relatively new investment vehicle for both residential and commercial property projects.

The crowdfunding concept is simple.

Large-scale real estate projects are put up for real estate investors (crowd) to pitch in money to fund them. As an investor, you become a stakeholder and earn rewards depending on several factors, including:

– A set dollar amount you receive back as part of the loan

– A cut of the project after completion

Crowdfunding is an excellent investment option for anyone looking for massive real estate deals.

Top Up Retirement Accounts

Investing your $100k in a retirement account is one of the smartest moves you can make. A comfortable retirement means you need to consider the current cost of living and estimate how much it would cost in the future, which can be a significant amount!

When an employer is offering a 401(k) to match your contributions and you are not contributing to, invest some of the $100k to free up space in your budget.

Another option is to contribute to a traditional IRA or Roth IRA. The retirement accounts have no yearly contribution limits. Consider padding these accounts so you are better prepared for retirement.

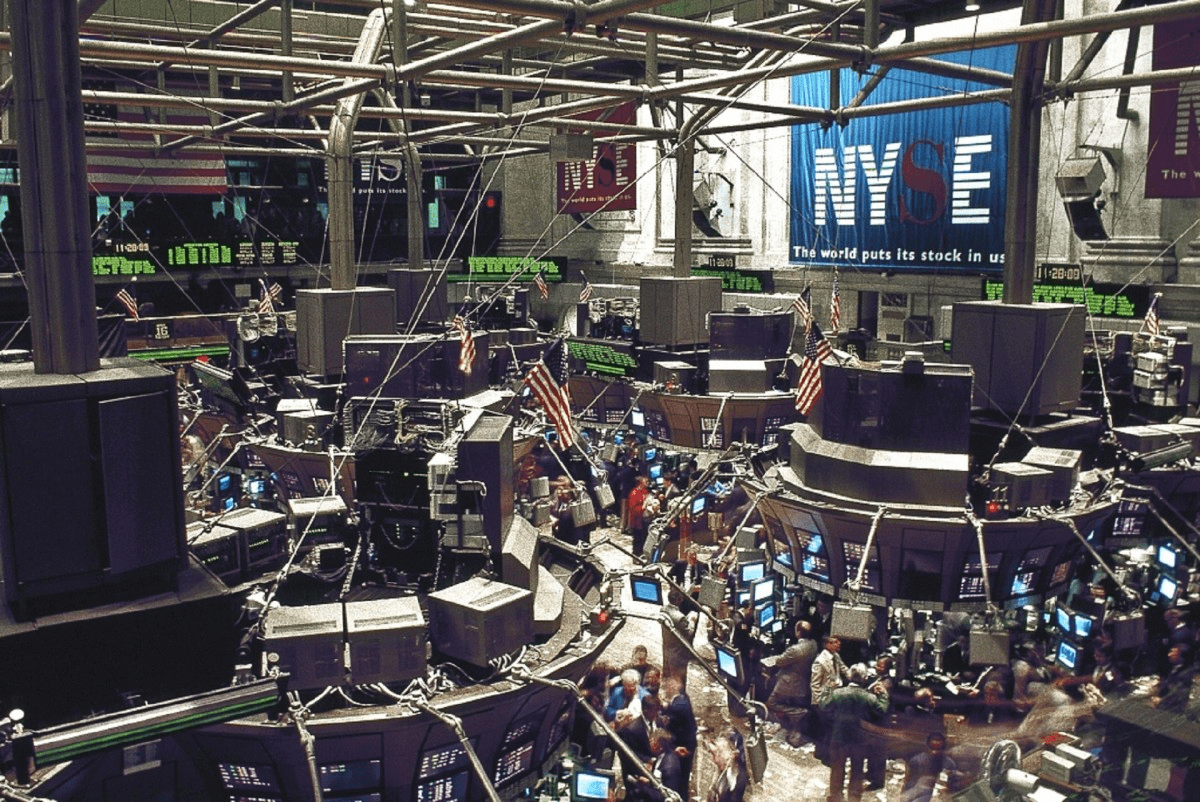

Invest in the Stock Market

Stocks should be at the top of the list when you are looking for ideas for what to do with 100k.

Investing in stocks offers some of the best investment portfolio diversification capabilities. You gain exposure to almost all industries and stocks offer the best returns on investment historically.

The idea of making a stock investment can be complex, so here are four methods you should consider when investing your $100,000.

Purchase Individual Stocks

The riskiest option, but it offers the biggest rewards. You need to know what you are doing when you pick a stock.

Individual stocks are also relatively liquid. Unlike physical assets, such as real estate, investing in stocks lets you liquidate the holdings in hours—if not minutes.

Stocks also have a relatively low entry barrier. If you are looking toward a $100,000 milestone, you can start your investment with a few dollars.

Purchase mutual funds and ETFs

Exchange-Traded Funds (ETFs) and mutual funds are pre-bundled baskets of stocks that help you make a single but instant diverse investment. However, there are differences in how they come together, are managed, and sold.

An ETF works like a stock and does not require active management. ETFs follow an index, and you have the option to go as narrow or broad as you want.

There is an option to focus on things important to you. For example, you can choose to invest in socially responsible businesses.

An individual or a group of people manages a mutual fund. While there are exceptions, most mutual funds have someone who picks the stocks in the fund.

Opt for a Robo-Advisor

Robo-advisors are a low-cost and easy means of investing $100k in stocks. A robo-advisor is a broker using a computer algorithm to build, monitor, and balance your stock portfolio. You just invest your money, tell the algorithm your risk levels and financial goals, and they do the rest.

DIY Investing

An option suitable for the investor interested in a hands-on investing experience and who prefers trading on their own.

Invest in Peer-to-Peer (P2P) Lending

P2P lending means you are loaning your money to someone who needs it.

Lending money offers several benefits over real estate and stocks, including:

– Strong returns of anywhere from 5% to 12% annually

– An excellent way to make a passive income when you work with P2P lending platforms and receive monthly or quarterly deposits

– You are helping others who need the money for items such as paying off debt, medical bills, or building their businesses

Invest in a Savings Account, Money Market Account (MMA), and Certificate of Deposit (CD)

If you have invested already or are not sure how to invest your 100k, there are several places to store your money.

The simplest way is to put the money in a savings account. Most banks have low-interest rates. Instead, consider a high-interest savings account.

A Money Market Account (MMA) works like a savings account, but the interest rates are higher.

An excellent alternative for your money is to park it in a CD. CDs have set terms that range from 30 days up to 10 years. There is an option to withdraw your money, but you lose part of the interest. A CD has higher interest and longer terms and comes with higher rates.

You can also leverage a jumbo CD that accepts balances from $100,000 and above.

The Bottom Line

When you have $100,000, you must know where to invest it. However, make sure you research the options for an informed decision. Always exercise due diligence so your money lands where you want.

The options available are many, from real estate to CDs. The journey to find the best way to invest 100k can be just as rewarding as investing the money!

Are you looking for more information on how to invest in real estate? Contact Ardor Homes Massachusetts today. They are professionals in selling and buying homes and can assist you in finding the perfect investment property.

In her 25-year career, Steph Wilkinson has been involved in the acquisition, marketing and sales of over $3 Billion dollars of residential real estate. A number of years ago, Steph transitioned into Brokerage Leadership for National real estate brands and tech start-ups. She has served as a Business Strategist for real estate agents and brokerages alike and is also a real estate coach and trainer. In her new role with the Iconic Team, Steph will be responsible for the growth of the team and will be working with all of our agents to increase their productivity and bottom line.