If you found this article, you probably have $30,000 that you want to work on. Maybe it’s from an inheritance or from selling a small business. Regardless of how the windfall occurred, you are here for one reason: you want to know how to get rich with 30k.

There are many ways on how to invest 30k depending on your goals and risk tolerance. In this article, we will outline a few different strategies that may be appropriate for your situation to make an informed decision about how and where to put your money. We also provide some additional resources at the end of this article if you need more help or information before deciding on a course of action.

Pro Tip: If you have more money to invest, check this article on how to invest one million dollars.

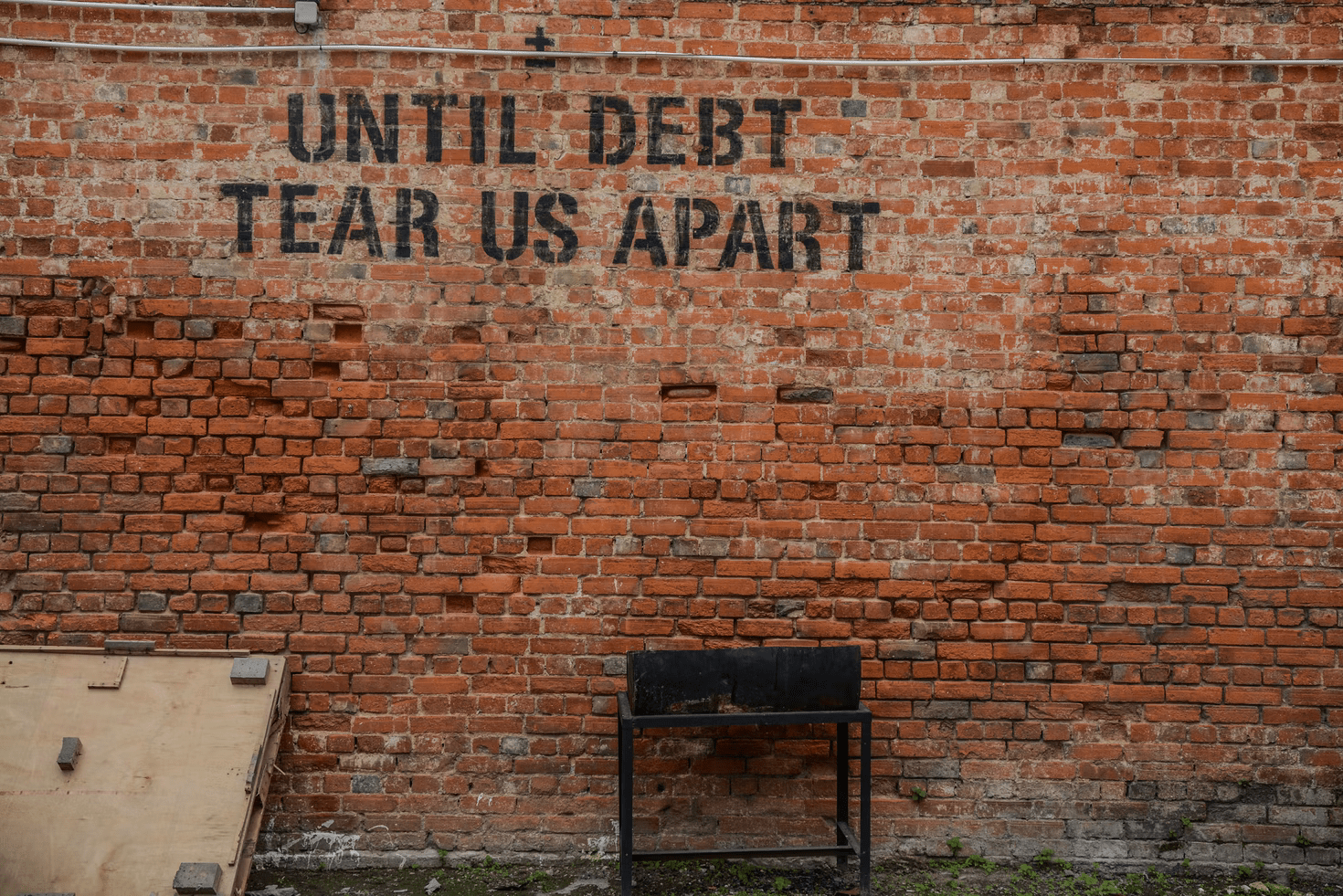

Pay Down Debt And Rebuild Your Credit Score

Paying off debt is one of the finest investments you can make. By paying off your debt, you save on interest, improve your credit score, reduce stress, and free up cash flow. Before investing, pay off high-interest loans such as credit cards and private student loans.

It’s essential to weigh the opportunity cost of investing versus paying down debt. For example, suppose you have a 5% interest rate loan with a minimum monthly payment of $300 per month and invest money in an index fund that returns an average of 8%. In that case, it may make sense to continue making minimum payments on the loan so that you can invest more money.

If the opposite is true (you have an 8% interest rate loan with a minimum monthly payment of $400 per month), then you should pay down your debt first before investing as much as possible outside of retirement accounts.

Open A 529 Plan And Invest In It

Let’s first get a basic understanding of what 529 plans are. 529 plans are savings plans that can help you save for future education expenses.

You may be wondering, “how exactly do they provide financial aid benefits?” When it comes time to fill out your FAFSA (Free Application for Federal Student Aid), the 529 accounts you own are considered assets, while the money in your child’s name is considered income (and income carries more weight than assets). This means that your child will likely qualify for more aid if you put their name on the account versus your name.

With that being said, it’s important to note that both parents and grandparents can open 529 accounts in their own names for children or grandchildren and still take advantage of this loophole!

If you know how to invest 30k into a 529 plan, you’ll get a significant tax break! And suppose you ever require the money for anything other than education expenses, such as a down payment on a house or an emergency fund boost. In that case, you can use up to $10k of the money per year toward qualified educational expenses without paying any federal taxes or penalties.

Savings Account

If you are new to investing or want a very safe and quick way on how to invest 30k, then a savings account is your best bet. While the interest rate will be low compared to other investments with more risk involved, a savings account is one of the safest ways to invest your money.

Your money is insured by the FDIC (Federal Deposit Insurance Corporation) for up to 250k, so there is no risk of losing money in it. Moreover, savings accounts can be used as an emergency fund for short term investments goals, paying off debt, etc.

The online banks’ great feature is that they tend to have higher interest rates than brick-and-mortar banks, so your money will grow faster while it sits in your savings account. These online banks also make opening an account super easy and fast.

Mutual Funds

A mutual fund is a professionally-managed investment portfolio. Imagine that you want to invest your $30,000 in stocks. However, it is difficult for you to manage the number of stock picks and keep track of them 24/7. With mutual funds, a professional fund manager does all that work, follows the market, and makes changes appropriately, giving you a great deal of convenience.

But what exactly are mutual funds? They are collections of securities like stocks and bonds that can be purchased as individual units. Mutual funds can also consist entirely of investments in money market account securities (liquid assets such as treasury bills), real estate holdings, or commodities like gold or silver bullion.

Most investors will choose pre-existing market index funds, which offer exposure to the entire U.S. stock market at a low cost while minimizing risk through a diversification effect across hundreds of companies. So, if you’re looking for a way on how to invest 30k that is low risk but still gives you good returns over time, investing in mutual funds is one option to consider.

Earn Passive Income With Real Estate

Real estate investment is one of the best ways to generate passive income. If there is one thing that you should know about how to invest 30k in real estate, if you own a rental property, your tenant pays the mortgage for you. That makes it one of the most powerful ways on how to get rich with 30k.

With that said, you don’t have to worry about paying the mortgage or rental property taxes because they have a legal obligation to make those payments through the lease agreement. Thus, real estate is an attractive investment strategy for investors looking to add diversification to their portfolios with many benefits, including cash flow and tax benefits with depreciation.

Moreover, the real estate market has been on fire for several years now, but there are still some good deals if you know where and how to look for them. The first step in learning how to invest 30k in real estate is finding out what type of properties are available around the areas where you live. So, when it’s time to purchase a new home, you can quickly move into place without having any problems getting approved by banks or lenders.

Real Estate Investment Trusts

Investing in real estate investment trusts (REITs) is a good way on how to invest 30k in real estate. REITs are firms that own and manage income-producing real estate, such as office buildings, apartments, shopping malls, etc.

They operate similarly to mutual funds, which allow you to pool your money together with other investors and have it professionally managed by an investment team that invests in large commercial real estate projects. This enables you to access investments that you wouldn’t otherwise be able to get as an individual investor.

You might be wondering: how can I use a real estate investment trust for my 30k? Because REITs are mandated by law to distribute at least 90% of their taxable income annually to shareholders, they tend to financially perform well and make for a great source of passive income.

Money Market Accounts

Money market accounts are similar to savings accounts. However, they differ in two key areas: interest rates and liquidity. Money market funds are a type of mutual fund designed for individuals who don’t want to lose any investment principal and don’t want to check their accounts daily. Additionally, money market accounts invest in various debt securities and can vary in terms of the quality of those investments.

For example, suppose you are searching for the best way to invest 30k today. In that case, you know how important it is to find options that will give you as much return on your investment as possible. Therefore, money market funds offer some unique benefits to help you achieve your financial goals.

Blue Chip Stocks

Blue-chip stocks are an excellent way to invest $30,000. These are the most stable corporations with established records of earning solid profits year after year, even in bad economic times. They also have concrete reputations for keeping their dividends paid each quarter, making them an intelligent way to build long-term wealth and income. For example, Coca-Cola (KO) is a blue-chip stock that makes sense to include in your portfolio.

Start Or Add To Your Retirement Funds (401k, IRA)

Let’s look at the differences between these retirement tools and some of the benefits of each. A 401(k) is an employer-sponsored retirement savings plan that allows employees to put money away for retirement in a tax-deferred account until they start withdrawing funds, usually in their 60s.

Likewise, a Roth IRA (Individual Retirement Account) is another retirement savings account. However, unlike a 401(k), anyone can open one, regardless of whether they have an employer who sponsors it or not. Deposits into your Roth IRA are after-tax contributions, meaning you don’t get any tax deduction for contributing to it. Yet, your money grows completely tax-free!

Another critical difference between these two types of accounts is that qualified withdrawals from a Roth IRA are completely tax-free in retirement (the only caveat being that the account must be five years old). In contrast, withdrawals from a 401(k) or traditional IRA are subject to income taxes when they leave the account.

Invest In A Small Business

If you have a good business idea and some time to work, starting a small business can be one of the best answers on what to do with 30k. Not only will you be putting your money to work, building something that could make more money in the future. But, as an entrepreneur or business owner, you’ll also gain valuable experience and skills that will help you in future ventures.

Of course, being successful with a small business takes more than just having a good idea. Thus, you’ll need to build up customer demand for your product or service and get enough customers on board. You’ll also want to put together a definite plan for how the business will make money and grow in the future so that investors can see there’s a clear path forward.

Put A Significant Down Payment On An Investment Property

Another way to invest your money is by making a down payment on an investment property. If you choose this path and plan to live in the house, you can put your 30k toward the down payment. Putting more money down when you purchase a home reduces the amount of your monthly payments. Additionally, it protects the lender if the real estate property loses value. It also helps you qualify for lower interest rates with your mortgage lender.

Invest In High-Interest Savings Accounts Or CD

A high-interest savings account or a certificate of deposit (CD) are probably the most common and lowest-risk options if you’re looking to park your money in cash. The FDIC insures bank accounts up to $250,000 per depositor per bank. Likewise, the National Credit Union Share Insurance Fund (NCUSIF) offers similar protection for credit union members.

These accounts are not tax-advantaged but can be used for emergencies or short term investments goal, such as a down payment on a car or house or investing. Interest rates vary based on your balance and the specific institution you choose.

If you want to keep your cash investment but still take advantage of the power of compounding interest over time, consider locking up your money in a CD that lasts anywhere from six months to five years. While the interest rates are often higher than what other types of investments offer, they aren’t as volatile as different types of stocks and bonds.

What Should Be Considered Before Investing Money, And Why Is Long-Term Investing Essential?

Investing should not be looked at as a quick way to make money. It is an excellent strategy for long-term wealth building and should be considered if you can invest for at least ten years.

The time horizon when investing matters because short term investments are generally riskier than long-term investments. For example, investing in individual stocks or stock mutual funds for one year can result in significant losses or gains depending on the market’s performance. In contrast, investing in a stock mutual fund over ten years typically results in smaller gains or losses because the market tends to go up rather than down over any ten-year period.

That said, there are instances where short term investments make sense, such as obtaining money for college tuition, buying a home within two years, covering living expenses while unemployed, and other similar situations where you need access to your money quickly with minimal loss of principal.

However, long-term investing is usually preferable for most people since it helps minimize risks due to market volatility. Moreover, many people regularly add new money into their portfolios over time, either by saving from current income or adding proceeds from selling other assets.

When Is The Best Time To Invest?

You’ve heard the phrase, “The best time to invest was 20 years ago; the second-best time is now.” And it’s definitely true! The sooner you begin saving and investing, the more time you have to benefit from the magic of compound interest. Even if your funds are limited at first, investing a little bit every month will pay off in a big way over time (more than investing larger amounts sporadically throughout the year). Therefore, by automating your investments, your money will work for you while you sleep, without thinking about it or lifting a finger!

Conclusion

Investing is essential for your financial future. However, it’s not enough to save money; you must invest it so your money can grow. By doing so, you can become wealthy by investing your funds.

There are many ways to do this, from the stock market and bonds to real estate. Some methods are riskier than others, but you should be fine as long as you have a trusted source who knows the industry well! That’s where HOMES by ARDOR comes in! We have a team of professional agents ready to help you find the right property for your first investment!

In her 25-year career, Steph Wilkinson has been involved in the acquisition, marketing and sales of over $3 Billion dollars of residential real estate. A number of years ago, Steph transitioned into Brokerage Leadership for National real estate brands and tech start-ups. She has served as a Business Strategist for real estate agents and brokerages alike and is also a real estate coach and trainer. In her new role with the Iconic Team, Steph will be responsible for the growth of the team and will be working with all of our agents to increase their productivity and bottom line.