There is no question that buying a home is expensive. But how much does a house cost, on average, in the United States? This can be an overwhelming question, especially for first-time homebuyers. While the answer may vary depending on the location, size of the home, and other factors, there are some general guidelines you can follow. In some states, the average cost is much higher than in others. But even if you’re looking for the cheapest states to buy a house, it can still be a major expense.

In this blog post, we’ll provide an overview of the typical costs associated with buying a property. Keep in mind that everyone’s experience will be different, so these costs may not apply to everyone. But if you’re curious as to how much does it cost to buy a house, read on.

Top Motivations for Owning a Home

The cost of a typical U.S. home has risen steadily for the past few years and shows no signs of slowing down. The increase is due to a variety of factors, including low-interest rates, a shortage of housing inventory, and strong demand from buyers.

Despite the rising costs, Americans still want to purchase or build a house. A recent survey from the National Association of Realtors found that 67% of homeowners feel independent, 64% are satisfied, and 61% are proud. Owning a home also has several financial benefits, such as building equity and creating a stable monthly payment. For many people, these rewards outweigh the challenges of rising prices.

How Much Does It Cost To Buy a House in the United States

So how much does a house cost? The answer varies depending on location, size, age, and many other factors. However, the average cost of a home in the United States is $43,874. This means that half of all homes cost more than this amount, and half cost less. This figure includes the down payment, closing costs, and the first monthly payment. Of course, these costs can vary significantly from one region to another. For instance, homes in expensive metropolitan areas are typically more expensive than those in rural areas. Similarly, larger homes tend to cost more than small ones.

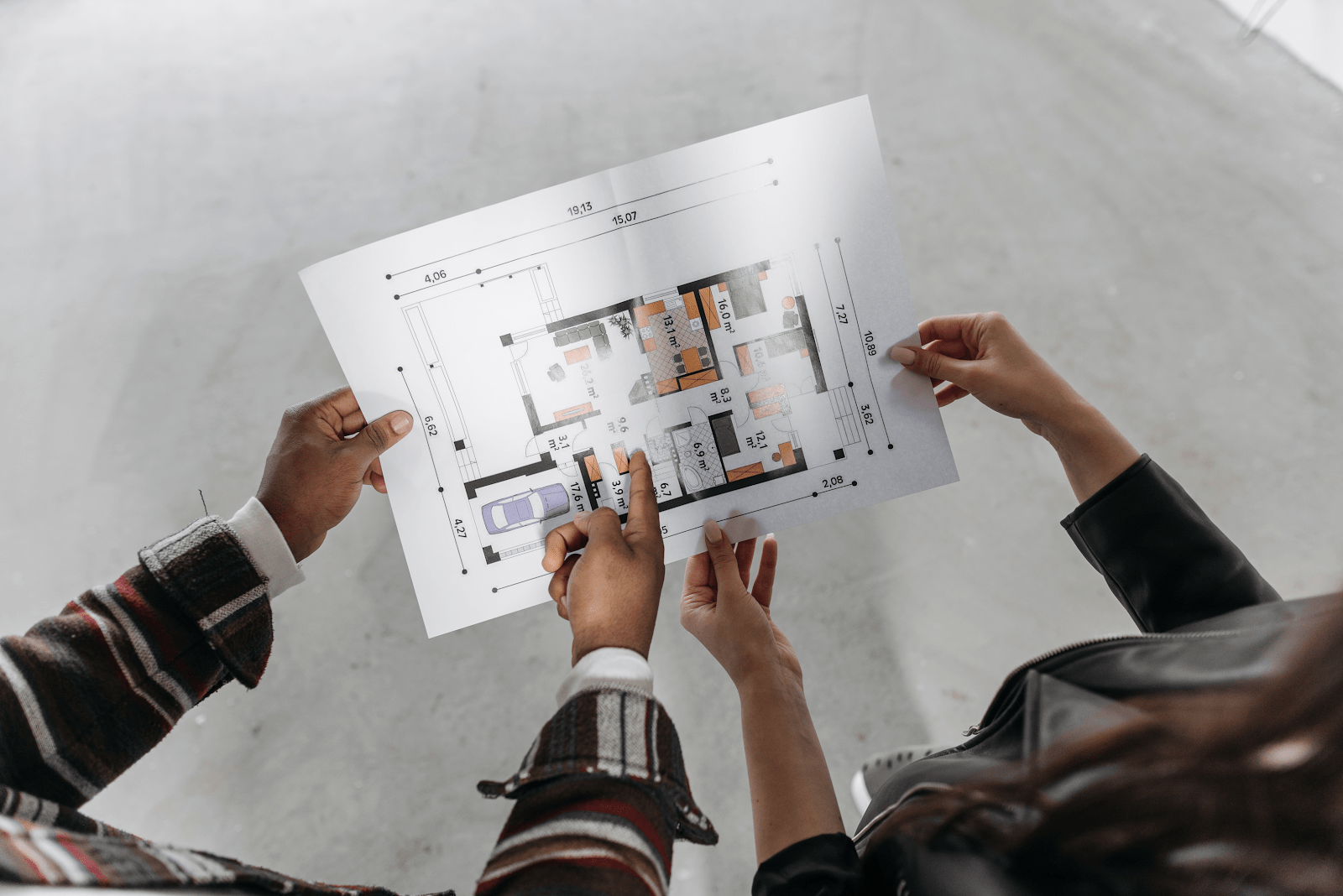

Factors That Can Affect the Cost of a House

When considering purchasing a house, there are many things that go into the overall cost. Here are some of the main factors that can affect how much you’ll end up paying.

- Location: A property’s location is a big consideration. Homes in desirable areas—like by the beach or in a major city—will typically be more expensive than those in less-desirable neighborhoods. Conversely, homes located in rural areas are typically much cheaper.

- Size and features of the house: Obviously, a larger home will cost more than a smaller one. The square footage, number of bedrooms, bathrooms, and features like a pool or Jacuzzi can increase the price tag.

- Age of the home: Generally speaking, newer homes tend to be more expensive than older homes. This is due to advancements in technology and materials over time, as well as increasing land values. However, older homes often need more repairs and updates, which can drive up the cost of repair or renovation.

- Condition of the home: The condition of a property can also have an impact on its price tag. A fixer-upper will usually be cheaper than a property that’s already been updated and is in move-in condition. If it’s in good condition, it will likely be worth more than a home that’s in need of repairs or renovation work.

- Neighborhood: Homes located in desirable neighborhoods tend to be pricier than those in less desirable areas. For example, an upscale, suburban neighborhood is going to have higher house prices than a more rural area because there are usually more amenities and services available in suburban areas, and people are willing to pay more for the convenience.

- Local economy: If an area is booming and jobs are plentiful, then people will be more likely to buy houses, driving up prices. On the other hand, if an area is struggling economically, then people may be hesitant to buy houses, causing prices to drop.

What Are the Costs Associated With Buying a Home?

Here is an outline of some of the most common expenses involved in buying a home, so that you can be better prepared when it comes time to take the plunge.

Down Payment

One of the many misconceptions in purchasing a house is that you need a 20% down payment of the selling price. In reality, there are many programs that allow lower down payments. For example, some loans only require a 3.5% downpayment for those who work in the military and public service and other first-time buyers that meet certain qualifications such as low income.

Lower down payment may seem like the smartest financial decision, but it’s not always the best idea. Larger down payment will usually result in a lower interest rate, and it can also help you avoid having to pay for mortgage insurance. A real estate consultant can help you figure out the smartest decision of how much to put down as a down payment.

Property Taxes

In most cases, the property tax rate is set by the local government. Depending on the location, size, and value of the home, property taxes can range from a few hundred dollars to several thousand dollars per year. Nationwide, the average property tax rate is 1.1% of a property’s assessed value. However, property taxes generally increase as the market value of a home rises. In some cases, the property tax bill can even be higher than the monthly mortgage payments.

Mortgage Insurance

Mortgage insurance protects the lender if the borrower defaults on the loan. The premium is paid by the borrower and is typically included in the monthly mortgage payment. The amount of the premium depends on the loan amount, the term of the loan, and the borrower’s credit history.

Mortgage insurance is typically required for loans with less than twenty percent (20%) down payment. For conventional loans, there are two types of mortgage insurance: private mortgage insurance (PMI) and lender-paid mortgage insurance (LPMI). PMI is paid by the borrower and LPMI is paid by the lender. The premium for LPMI is usually higher than PMI. Mortgage insurance is not required for government-insured loans, such as FHA loans. VA loans do not require mortgage insurance, but they do charge a funding fee, which can be added to the loan amount or paid in cash at closing.

Home Insurance

The cost of insurance can vary depending on the type and location of the home. While some buyers may be tempted to skimp on insurance in order to save money, this can be a risky proposition. Home insurance protects against a variety of risks, including fire, theft, and damage from weather events. Without adequate coverage, homeowners could find themselves facing significant financial losses in the event of an accident or disaster.

Closing Costs

Closing costs typically range from 2% to 5% of the total price of the home, so on a $200,000 home, you could be looking at $4,000 to $10,000 in additional costs. Closing costs can include things like appraisal fees, loan origination fees, title insurance, and more. They can also include inspection fees and legal fees.

Altogether, closing costs can add up to several thousand dollars. That’s why it’s important to factor them into your budget when you’re considering how much a house will cost you. You may be able to negotiate with the seller to have them cover some or all of the closing costs. In most cases, your real estate agent will be able to help you estimate your closing costs so you can make sure you have enough money saved up before you start the home-buying process.

Maintenance and Repairs

Maintenance and repair costs can be some of the most difficult to predict. Depending on the age and condition of your home, you may need to replace major systems like heating and cooling or make repairs to things like the roof or foundation. Even if your home is in good condition, there will always be small repairs that need to be made from time to time.

There are a number of ways to estimate these costs. You can ask the previous owners how much they spent on repairs, look at comparable homes in the area, or consult with a professional home inspector. No matter how you estimate it, though, be sure to set aside some money each month to cover unexpected repair costs.

Renovations

When you buy an older home, there’s always the potential for hidden costs in the form of needed renovations. Even a home that appears to be in good condition may have outdated wiring, plumbing, or appliances that will need to be replaced. And if there are any structural issues, such as a leaky roof or foundation problems, those will need to be fixed as well. While it’s impossible to know exactly what kind of renovations a home will need, it’s important to factor those costs into your budget when you’re considering purchasing an older property.

Moving Costs

Moving is often one of the most stressful and expensive parts of buying a home. This includes the cost of hiring a moving company, renting a truck, and other related expenses. The cost of moving can vary depending on the size of your home, the distance you are moving, and other factors. However, there are some ways to save money on moving costs. For example, you can ask friends and family to help with the move, or you can rent a smaller truck to save on fuel costs. You can also try to schedule your move during the off-peak season when rates are lower.

Most Unexpected Housing Costs

A recent survey by ConsumerAffairs found that the majority of buyers are caught off guard by unexpected costs associated with homeownership.

According to the survey, the most common unexpected cost is property taxes, with nearly 36% of respondents saying they had to spend more than they anticipated on fixing up their homes. Other common unexpected costs include utilities (26%), maintenance and repairs (20%) homeowners association fees (7%), landscaping (3%), and natural gas (3%).

Of course, every home is different, and there’s no way to know how much you’ll need to spend on unexpected costs until you actually start living on the property. However, it’s important to be prepared for the possibility that you may need to spend more than you originally budgeted for.

Takeaways

While the cost of a house will vary depending on the location, size, and features of the home, there are some general trends that can be observed across the United States. If you’re thinking of buying a home in the near future, it’s important to understand what costs to expect and how they might affect your budget. Keep in mind that this is just a starting point. At Ardor Homes Massachusetts, our expert consultants can provide you with detailed breakdowns of all costs associated with buying a home so that you can make an informed decision.

In her 25-year career, Steph Wilkinson has been involved in the acquisition, marketing and sales of over $3 Billion dollars of residential real estate. A number of years ago, Steph transitioned into Brokerage Leadership for National real estate brands and tech start-ups. She has served as a Business Strategist for real estate agents and brokerages alike and is also a real estate coach and trainer. In her new role with the Iconic Team, Steph will be responsible for the growth of the team and will be working with all of our agents to increase their productivity and bottom line.