It has finally happened! You’ve found the house of your dreams and you’re ready to make an offer. But is there a best and worst day to close on a house? Surprisingly, the answer to that questions is: yes!

Real estate closings involve a process filled with both excitement and uncertainty. In this article, we’ll discuss who sets the closing date and when it’s typically scheduled. We’ll also reveal the best and worst days to close on a house.

You might be surprised to learn that the day of the week can make a big difference to how much money you pay and how smoothly the process goes. Keep reading to find out more!

What is a Real Estate Closing Date?

A real estate closing date is the date on which a property transaction will be completed. It is also referred to as the settlement or closing day. Ultimately, this signifies the closing of the property sale and the successful transfer of the title to the buyer.

What Happens on Closing Day

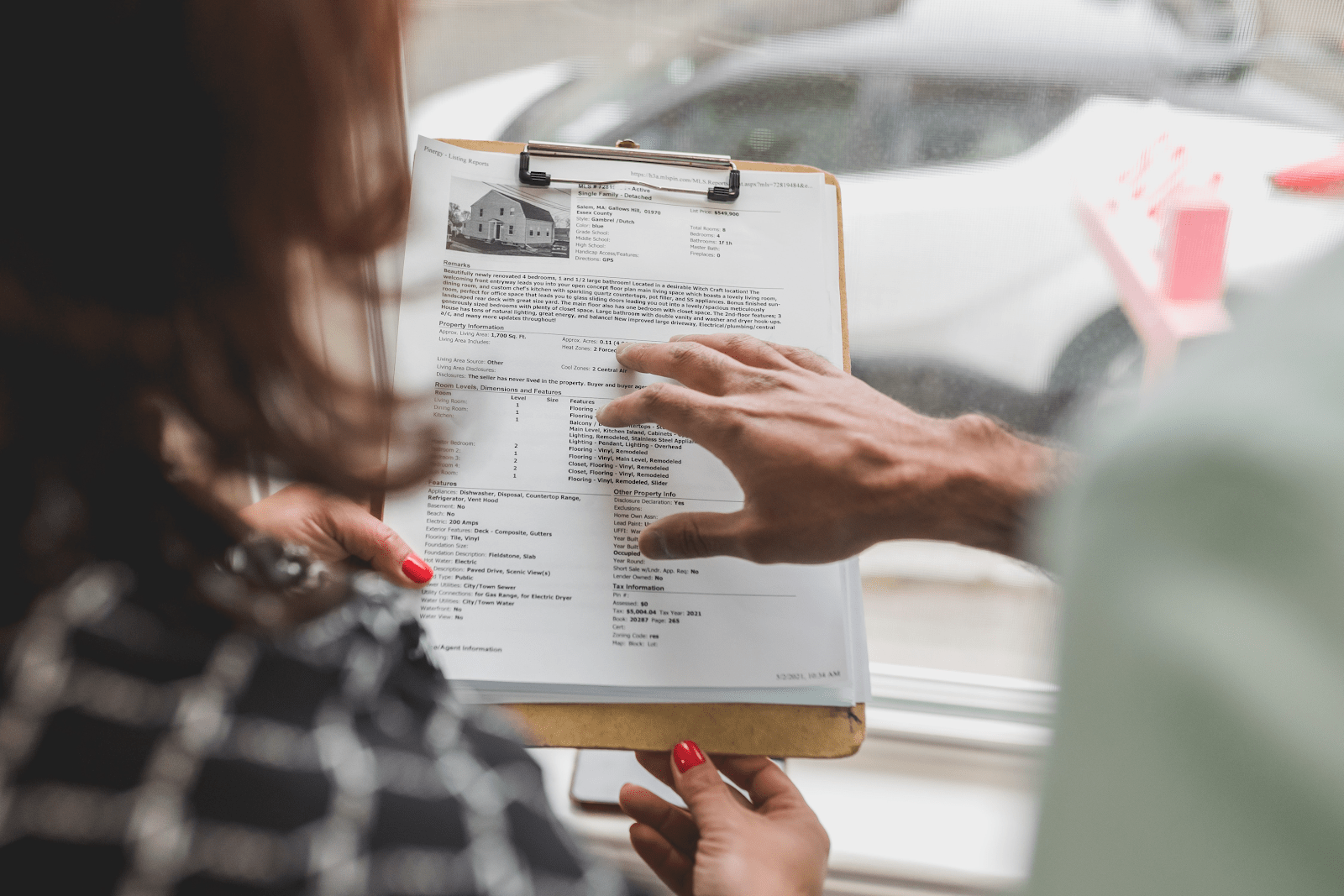

The completion process is governed by the seller’s and buyer’s legal representatives, with their mortgage broker and real estate agent also playing a crucial role. The buyer and seller enter into a real estate transaction that involves legal processes and closing documents, including:

-

Parties involved:

Mortgage Lender – Provides funding for your mortgage and collects monthly payments until your mortgage is paid in full.

The title company – Provides title insurance and handles the title search and paperwork associated with transferring ownership of a property from the seller to the buyer.

Escrow officer – Coordinates the transfer of funds between buyer, seller, mortgage lender, and title company.

Real estate attorney – Reviews documents at closing and advises clients on legal issues concerning their purchase or sale of real estate.

-

Closing Documents

The purchase contract – This is a legally binding purchase agreement between the buyer and seller that outlines all of the terms of the sale. It includes an agreed-upon price, conditions of sale, and time frame.

The financing documents – These are documents that show how much money you have borrowed from a lender to pay for your home. They also show how much interest you will pay on your loan during its term.

How Long Does Closing Take?

Closing on a real estate property normally takes 30 to 45 days but this depends on a couple of factors such as the type of loan type and the status of the real estate market.

The financial capacity of the buyer, as well as the appraisal and home inspection of the seller’s property, can have a huge impact on the length of the process.

The key to getting a mortgage fast is organisation and clear communication with your lender and seller.

Who Schedules the Closing Date?

Either the buyer and seller can choose the closing date but they must both agree to it.

Before scheduling the date and signing the closing papers, a final walk-through of the property must be conducted to make sure nothing has been damaged since the last home inspection. You should also verify that all repairs required by the seller have been completed and ensure that nothing included in the purchase agreement was removed.

Does Your Closing Date Really Matter?

Yes, your real estate closing date does matter. In fact, it is one of the most important dates in the life of the property. It is the date when you will be given title to the house or apartment you are buying and all the money that has been paid to you by the seller will be yours.

The closing date can also be a very stressful one for buyers because it is typically when all the paperwork for your application for a loan has been processed and approved by the lender who holds your mortgage.

If there are any problems with your application, such as insufficient funds in your account or incorrect information on your credit report, you may have to wait until those issues are resolved before you can close on your purchase.

The right closing date—one that is mutually agreeable to buyer and seller—can help you minimize your closing costs and streamline your home-buying process.

What is the Best And the Worst Day to Close on a House?

Here are the best and worst options and strategies to close on a home property that will either help you pay less at closing or have more time to save for your first payment.

Before the lender’s loan commitment expires. As a lender, it is essential that the loan closing occurs prior to the expiration date of the loan commitment. Doing so will enable you to enjoy the promised interest rate and avoid the need to re-negotiate the loan package or pay a higher rate.

The latter part of the month. Scheduling the closing date on the house in the latter part of the month will decrease closing costs and interest.

Early in the month. Setting your closing date in the early part of the month will allow you to save and prepare for the first mortgage payment.

Fridays or before federal holidays. It may seem tempting to schedule closing for a Friday at the end of the month or just before a long weekend, but this practice should be avoided. Under no circumstances should you allow your home-buying process to be rushed, because mistakes made under pressure could cost you money.

In the middle of the week. Experts recommend that you choose a date near the middle of the week so all the parties involved will be able to complete all the paperwork in a timely fashion.

Before your scheduled move-in date. To avoid paying extra interest on your home loans, real estate agents and experts recommend setting the closing date way before you intend to move in and occupy the property.

A date that is mutually reasonable for the home buyer and seller. The seller must choose a closing date that allows ample time to finish any renovations and move before the new owner takes possession. The buyer should allow plenty of time to apply for a mortgage and complete the purchase.

The closing date should take into consideration any necessary inspections, the title report review, any circumstances, such as an out-of-town trip or a time-sensitive estate or probate situation, and other factors that may be relevant, including the need for legal assistance.

Takeaway

The closing date is an important factor in successful real estate transactions. It can make or break a real estate deal. Learning that you have the option to choose your closing date is great, but all too often, procrastination bites and money is wasted. A few minutes of quick research can ensure that you will save money when buying a home, as well as avoid losing out on a place due to indecisiveness.

In her 25-year career, Steph Wilkinson has been involved in the acquisition, marketing and sales of over $3 Billion dollars of residential real estate. A number of years ago, Steph transitioned into Brokerage Leadership for National real estate brands and tech start-ups. She has served as a Business Strategist for real estate agents and brokerages alike and is also a real estate coach and trainer. In her new role with the Iconic Team, Steph will be responsible for the growth of the team and will be working with all of our agents to increase their productivity and bottom line.